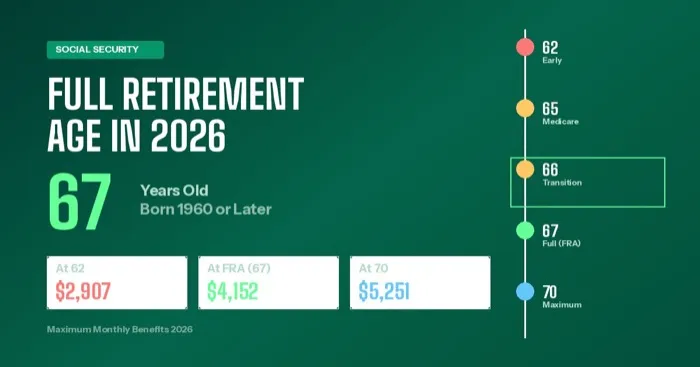

If you were born in 1960 or later, your full retirement age for Social Security is 67. Not 65. Not 66. It is 67, and that number is now locked in permanently.

This matters because claiming even one year too early could cost you tens of thousands of dollars over your lifetime. And waiting a few extra years past your full retirement age could add thousands more. The difference between a $2,000 monthly check and a $2,800 monthly check often comes down to one decision: when you start collecting.

In 2026, roughly 71 million Americans receive Social Security benefits totaling over $100 billion per month. Whether you are planning to retire soon, already collecting, or just want to understand how the system works, this guide breaks down the retirement age rules, benefit calculations, and earnings limits that apply right now.

Full Retirement Age by Birth Year

Your full retirement age (FRA) is the age at which you qualify for 100% of your calculated Social Security benefit. It is set by law based on your year of birth and has not changed since the 1983 amendments to the Social Security Act.

| Year of Birth | Full Retirement Age |

|---|---|

| 1943 to 1954 | 66 |

| 1955 | 66 and 2 months |

| 1956 | 66 and 4 months |

| 1957 | 66 and 6 months |

| 1958 | 66 and 8 months |

| 1959 | 66 and 10 months |

| 1960 or later | 67 |

If you are turning 62 in 2026, you were born in 1964, and your FRA is 67. You are eligible to start collecting early benefits right now, but doing so comes with a permanent reduction.

What Happens If You Claim Early (Before FRA)

You can start collecting Social Security as early as age 62. But "early" does not mean "free." The Social Security Administration applies a permanent reduction to your monthly benefit for every month you claim before reaching your full retirement age.

Here is how the math works for someone with an FRA of 67.

| Age You Start Collecting | Permanent Benefit Reduction | You Receive This % of Full Benefit |

|---|---|---|

| 62 | 30.0% | 70.0% |

| 63 | 25.0% | 75.0% |

| 64 | 20.0% | 80.0% |

| 65 | 13.3% | 86.7% |

| 66 | 6.7% | 93.3% |

| 67 (FRA) | 0% | 100% |

The word "permanent" is critical here. This is not a temporary discount. If you claim at 62 and receive 70% of your benefit, that reduced amount (adjusted for annual COLA increases) is what you will receive for the rest of your life.

A real example. Say your full benefit at age 67 would be $2,071 per month (the current average for retired workers in 2026). If you claim at 62 instead, you would receive about $1,450 per month. Over 20 years, that is roughly $149,000 less in total benefits.

What Happens If You Wait Past FRA (Delayed Retirement Credits)

On the other hand, if you can afford to wait past your full retirement age, Social Security rewards you with delayed retirement credits. For every year you delay between FRA and age 70, your benefit increases by 8% per year. That is two thirds of one percent for each month.

| Age You Start Collecting | Benefit Increase Over FRA | You Receive This % of Full Benefit |

|---|---|---|

| 67 (FRA) | 0% | 100% |

| 68 | 8% | 108% |

| 69 | 16% | 116% |

| 70 | 24% | 124% |

There is no benefit to waiting past age 70. Credits stop accumulating at that point.

Using the same example. If your FRA benefit is $2,071 per month and you wait until 70, your monthly check jumps to about $2,568. Over 20 years starting at age 70, that adds up to roughly $267,000 more than claiming at 62.

Maximum and Average Benefits in 2026

Following the 2.8% cost of living adjustment (COLA) that took effect in January 2026, here are the current benefit numbers.

| Benefit Type | Monthly Amount (2026) |

|---|---|

| Average retired worker benefit | $2,071 |

| Maximum benefit at age 62 | $2,831 |

| Maximum benefit at FRA (67) | $4,152 |

| Maximum benefit at age 70 | $5,251 |

To qualify for the maximum benefit, you would need to have earned at or above the taxable maximum ($184,500 in 2026) for at least 35 years. Most people will not hit the maximum, but the average benefit of $2,071 reflects what a typical retired worker actually receives.

For more details on the 2026 COLA increase and how it affects your specific payment, check our full COLA breakdown.

The Earnings Test: Working While Collecting

Many people continue working after they start collecting Social Security. That is fine, but if you are below your full retirement age, there are limits on how much you can earn before benefits get temporarily reduced.

| Your Situation in 2026 | Annual Earnings Limit | Benefit Reduction |

|---|---|---|

| Under FRA for the full year | $24,480 | $1 withheld for every $2 over the limit |

| Reaching FRA during 2026 | $65,160 (months before FRA only) | $1 withheld for every $3 over the limit |

| Already at or past FRA | No limit | No reduction |

Here is the good news: any benefits withheld because of the earnings test are not lost forever. Once you reach your full retirement age, the SSA recalculates your benefit to credit you for the months where payments were reduced. Your monthly amount goes up to account for what was withheld.

Who Can Collect Social Security Benefits?

Social Security is not just for retired workers. Benefits are available to several groups.

- Retired workers who have earned at least 40 work credits (roughly 10 years of employment).

- Spouses of retired or disabled workers, even if they never worked themselves. Spousal benefits can be up to 50% of the worker's FRA benefit.

- Survivors. Widows, widowers, and dependent children of deceased workers may qualify for survivor benefits.

- Disabled workers who meet the SSA's definition of disability can receive SSDI benefits before reaching retirement age.

- Children of retired, disabled, or deceased workers (under 18, or under 19 if still in high school).

Currently, about 71 million Americans receive Social Security benefits. That includes retired workers, their dependents, survivors, and disabled workers.

Is There a Proposal to Raise the Retirement Age Again?

Not in 2026. The current full retirement age of 67 (for those born in 1960 or later) represents the final step in a gradual increase that started with the 1983 Social Security amendments. There are no new laws taking effect in 2026 that would change the retirement age.

That said, Social Security's long term finances remain a topic of ongoing debate in Congress. Various proposals have surfaced over the years to raise the FRA to 68, 69, or even 70. None have passed, and none are currently scheduled for a vote. But the conversation is not going away, especially as the program's trust fund reserves continue to decline.

For now, the rules are the rules. If you were born in 1960 or after, your full retirement age is 67.

How to Check Your Estimated Benefits

You do not have to guess what your Social Security benefit will be. The SSA provides a personalized estimate based on your actual earnings history.

Step 1. Create an account at my.ssa.gov if you have not already.

Step 2. Log in and view your Social Security Statement. It shows your estimated monthly benefit at age 62, at your full retirement age, and at age 70.

Step 3. Review your earnings record. Make sure all your past income is listed correctly. Missing years of income will lower your estimated benefit.

The SSA also offers a Retirement Estimator that lets you test different scenarios, like "what if I work two more years" or "what if I earn more next year."

The Bottom Line: When Should You Claim?

There is no universal right answer. The best age to claim Social Security depends on your health, your savings, whether you plan to keep working, and whether you have a spouse whose benefits are tied to yours.

Claiming at 62 might make sense if you have health concerns that may shorten your life expectancy, you have no other income and need the money, or you have a solid investment portfolio and plan to invest the benefit checks.

Waiting until 67 or later makes sense if you are in good health, you are still working and earning above the earnings test limits, your spouse will rely on your benefit for survivor benefits, or you want the guaranteed 8% annual increase that comes from delayed retirement credits.

Every year you wait between 62 and 70 adds money to your monthly check for life. For many people, that patience pays off in a meaningful way.

Sources

Written by

Margaret Hayes

Social Security policy reporter and former AARP contributor covering retirement benefits.