Your Social Security check got a raise in January, but the number hitting your bank account may not be what you expected.

The Social Security Administration announced a 2.8% cost-of-living adjustment (COLA) for 2026, adding roughly $56 per month to the average retiree's benefit. That sounds like welcome news until you factor in the Medicare Part B premium increase, which quietly offsets a significant chunk of the raise.

Here's exactly what changed, what your new payment will be, and what most news outlets aren't telling you about the math.

What Is the 2026 COLA and How Is It Calculated?

Every year, the Social Security Administration adjusts benefits based on the Consumer Price Index for Urban Wage Earners (CPI-W). If prices go up, benefits go up to help recipients maintain their purchasing power.

For 2026, the CPI-W data from the third quarter of 2025 showed a 2.8% increase over the same period in 2024. That percentage is applied automatically to every Social Security beneficiary's monthly payment.

This is the smallest COLA since 2024's 3.2% adjustment and significantly lower than the 8.7% increase in 2023, which was driven by post-pandemic inflation.

The Dollar Breakdown by Benefit Type

The 2.8% COLA applies differently depending on what type of Social Security benefit you receive:

| Benefit Type | 2025 Average | 2026 Average | Monthly Increase |

|---|---|---|---|

| Retired worker | $2,015 | $2,071 | +$56 |

| Retired couple (both receiving) | $3,182 | $3,271 | +$89 |

| SSDI (disabled worker) | $1,580 | $1,624 | +$44 |

| SSI (individual) | $967 | $994 | +$27 |

| Survivor (aged widow/er) | $1,832 | $1,883 | +$51 |

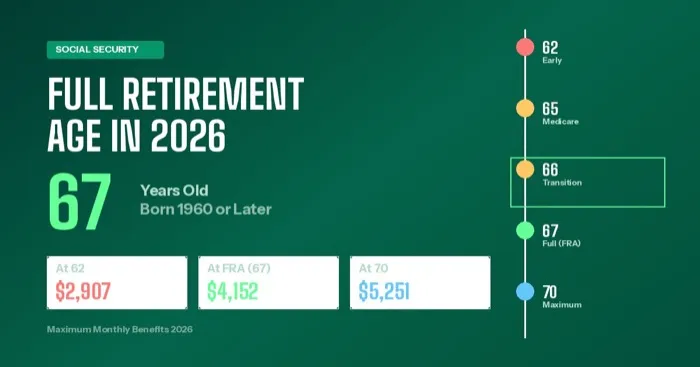

The maximum Social Security benefit for someone retiring at full retirement age in 2026 is $4,152 per month, up from $4,018 in 2025.

Also Read

The Medicare Offset Nobody Talks About

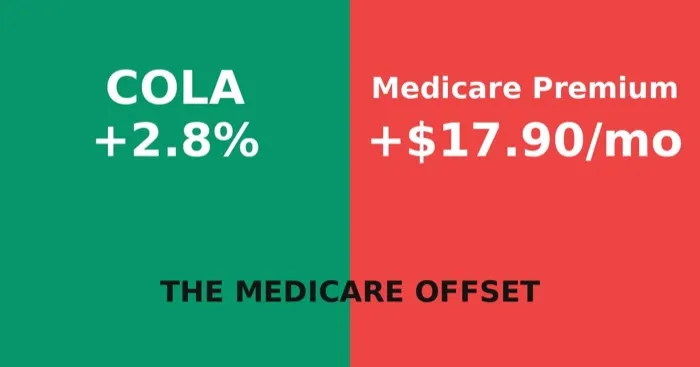

Here's what makes the 2026 COLA frustrating for many retirees: the Medicare Part B premium also went up.

The standard Medicare Part B premium for 2026 is $202.90 per month, an increase of $17.90 from 2025's $185.00. Since approximately 70% of Medicare beneficiaries have their premiums deducted directly from their Social Security payments, the net effect looks like this:

Gross COLA increase: +$56/month

Medicare Part B increase: -$17.90/month

Net increase in your check: +$38.10/month

That's the reality for most retirees. Your Social Security payment goes up by $56, but $17.90 of it immediately goes to Medicare, leaving you with roughly $38 more per month, about $1.27 per day.

Other 2026 Changes That Affect Your Benefits

The COLA isn't the only thing that changed for 2026. Several other Social Security thresholds were adjusted:

Earnings test limit increased. If you're under full retirement age and still working, you can now earn up to $24,480 per year (up from $23,400) before Social Security withholds benefits. For the year you reach full retirement age, the limit is $65,160 (up from $62,160).

Maximum taxable earnings rose. The wage cap for Social Security taxes increased to $184,500 for 2026, up from $176,100. If you earn above this amount, you won't pay Social Security tax on income above the cap.

Full retirement age continues its shift. For people born in 1960 or later, full retirement age remains 67. If you were born in 1959, your FRA is 66 and 10 months.

2026 Social Security Payment Schedule

Social Security payments are delivered based on your birth date. Here's when to expect your February and March 2026 payments:

| Birth Date | February Payment | March Payment |

|---|---|---|

| 1st to 10th | February 11, 2026 | March 11, 2026 |

| 11th to 20th | February 18, 2026 | March 18, 2026 |

| 21st to 31st | February 25, 2026 | March 25, 2026 |

| SSI recipients | February 2, 2026 | March 2, 2026 |

If your payment date falls on a federal holiday or weekend, you'll receive your deposit on the preceding business day. All payments are made by direct deposit unless you have a specific exception on file with SSA.

Also Read

How to Verify Your New Payment Amount

If you want to confirm your exact 2026 benefit amount, you have three options:

1. My Social Security account (ssa.gov). Log into your online account to see your current benefit amount, payment history, and any deductions including Medicare premiums.

2. SSA-1099 form. Your Social Security Benefit Statement for tax year 2025 was mailed in January 2026 and shows your total benefits and any adjustments.

3. Call SSA directly. You can reach the Social Security Administration at 1-800-772-1213 (TTY 1-800-325-0778), Monday through Friday, 8 a.m. to 7 p.m. local time.

What to Expect for 2027

Early forecasts from the Senior Citizens League suggest the 2027 COLA could be in the range of 2.2% to 2.6%, depending on how inflation trends through the rest of 2026. The official announcement won't come until October 2026, based on third-quarter CPI-W data.

For now, the 2.8% adjustment is locked in for the full calendar year. If you haven't already checked your January or February payment to confirm the increase, log into your My Social Security account today.

The Bottom Line

The 2026 COLA adds $56 per month to the average retiree's Social Security benefit, but after the Medicare Part B premium increase, most people will see about $38 more per month. It's not nothing. It's an extra $457 over the year. But it's a reminder that the COLA is designed to keep pace with inflation, not outpace it.

If you're planning your retirement budget for 2026, use the net number after Medicare, not the gross COLA figure. That's the number that actually hits your bank account.

Sources

Written by

Margaret Hayes

Social Security Editor covering retirement benefits and Medicare.