If you're expecting a paper check from the IRS this year, you need to read this carefully.

Starting in 2026, the IRS has fundamentally changed how tax refunds are delivered. Under Executive Order 14247, signed in late 2025, the agency began phasing out paper refund checks entirely. The shift means that if you file without providing bank account information, your refund will be frozen, not mailed.

This is the single biggest change to the refund process in over two decades, and millions of taxpayers are still unaware.

What Exactly Changed?

In previous years, if the IRS couldn't process a direct deposit due to a missing or invalid bank routing number, they'd automatically convert your refund to a paper check and mail it.

That safety net is gone.

Starting with the 2026 filing season, the IRS will:

- Freeze refunds when direct deposit information is missing or invalid

- Not automatically issue paper checks as a fallback

- Hold frozen refunds until the taxpayer provides valid direct deposit details

- No longer reissue rejected deposits as paper checks

According to the Taxpayer Advocate Service, this change applies to all electronically filed and paper-filed returns. The IRS will contact affected taxpayers, but the process could add weeks or even months to your refund timeline.

Who Is Most Affected?

This change disproportionately impacts several groups:

Unbanked Americans. Roughly 5.9 million U.S. households don't have a bank account, according to the FDIC's most recent survey. These taxpayers previously relied on paper checks and now need alternative arrangements.

Elderly filers. Many seniors still prefer paper checks and may not have current banking information on file with the IRS.

Taxpayers who changed banks. If you switched banks since your last filing and forgot to update your direct deposit information, your refund could be frozen.

EITC and ACTC recipients. These refunds are already held until after February 15 by law. An additional freeze on top of the EITC hold could push refunds back by several weeks.

Also Read

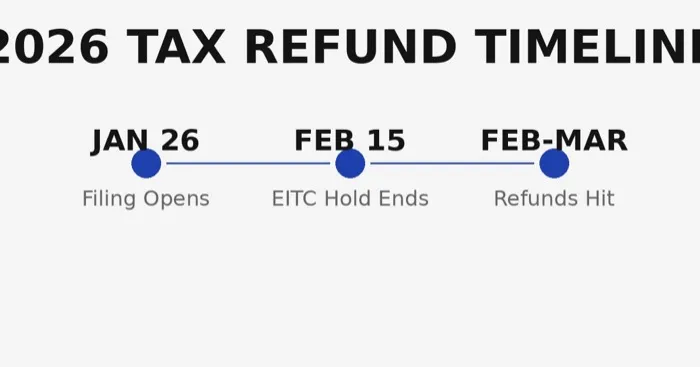

The 2026 Refund Timeline: Key Dates

Here's every date that matters this tax season:

| Milestone | Date |

|---|---|

| Filing season opens | January 26, 2026 |

| EITC/ACTC refund hold ends | February 15, 2026 |

| First EITC refunds expected | March 2, 2026 |

| Filing deadline | April 15, 2026 |

The IRS says most e-filed returns with direct deposit are processed within 21 days. Last year's average refund was $3,167, and analysts at the Associated Press expect this year's average to be roughly $1,000 higher due to new deductions under the 2025 tax law — including no tax on tips, no tax on overtime, and the enhanced deduction for seniors.

What If You Don't Have a Bank Account?

You're not stuck. The IRS has provided several alternatives:

Prepaid debit cards. You can receive your refund loaded onto a prepaid Visa or Mastercard. Many tax preparation services offer these at filing time.

Digital wallets. PayPal, Venmo, and Cash App now accept IRS direct deposits via their routing and account numbers. Check with your provider for specific setup instructions.

Credit union accounts. Many credit unions offer free checking accounts with no minimum balance requirements. Some can be opened online in minutes.

Limited paper check exceptions. In specific hardship cases, the IRS may still issue paper checks, but you'll need to request this through the Taxpayer Advocate Service.

How to Track Your 2026 Refund

The IRS offers three tools to check your refund status:

1. Where's My Refund (irs.gov/refunds). Enter your Social Security number, filing status, and exact refund amount. The tool updates once per day, usually overnight. E-filers can check within 24 hours of IRS acceptance.

2. IRS2Go mobile app. The official IRS app for iOS and Android provides the same refund tracking as the website, plus push notifications when your status changes.

3. IRS Online Account. Log in at irs.gov to view your full tax account, including refund details, payment history, and any pending actions.

Also Read

What You Should Do Right Now

If you haven't filed yet, here's your action plan:

Step 1: Verify your bank information. Double-check that your routing number and account number are current. If you switched banks recently, update your info before filing.

Step 2: File electronically. E-filing with direct deposit is the fastest path to your refund. The IRS processes electronic returns in 21 days versus six weeks or more for paper returns.

Step 3: Set up an IRS online account. If you don't have one yet, create an account at irs.gov. This gives you direct communication with the IRS and faster resolution if any issues arise.

Step 4: Don't wait until April. Early filers get refunds first. With the new no-paper-check policy, any issues with your direct deposit information will take longer to resolve the closer you file to the deadline.

The Bottom Line

The IRS paper check phase-out is the biggest change to the refund process in years. If you do nothing else after reading this, verify your direct deposit information before you file. One wrong digit in your routing number could freeze your refund for weeks.

The average refund this year is expected to top $4,000. Don't let a paperwork issue keep your money locked up.

Sources

Written by

Rachel Morrison

Senior Tax Correspondent covering IRS policy and federal payments.